This year has been filled with challenges, and that’s certainly true for The Walt Disney Company as well.

©The Walt Disney Company

We’ve seen a massive restructuring in the entertainment aspect of the company; and Disney theme parks around the world temporarily closed, some reopened, and then some closed again. We’ve also seen large layoffs announced for the Parks, Experiences and Products division. But, today, just days ahead of Disney’s Virtual Investor Day, Disney stock is trading at some of the highest values its seen all year.

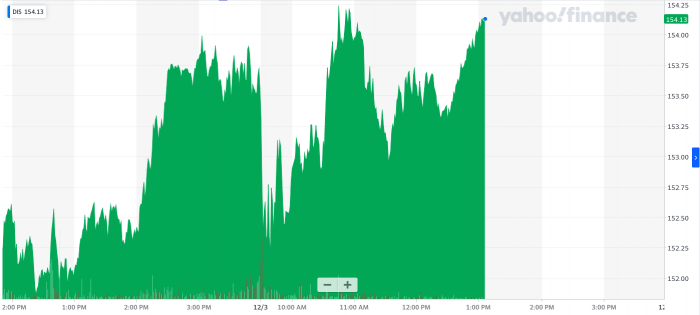

Of course, stock trading values fluctuate throughout the day, and they even fluctuated as we were writing this article, but today we’ve seen some high trading values for Disney Stock — around $153 and $154 per share. Yahoo! Finance lists today’s open as $153.45, with today’s range as $152.13 – $154.44.

©Yahoo! Finance

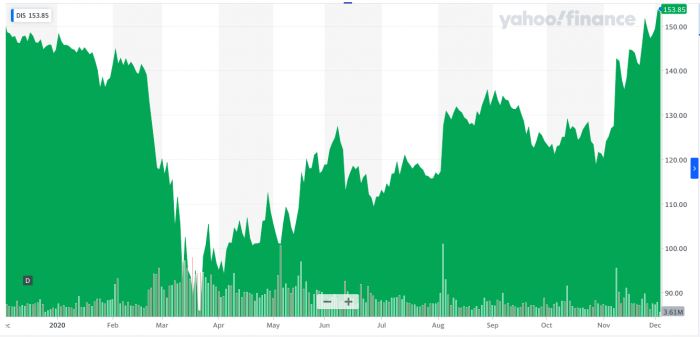

Here’s a look at the stock trading values over just the last six months. You can really see how the value has gone up over time.

©Yahoo! Finance

The 52-week range for the stock is $79.07 – $154.44. This is what the development of the stock trading value has looked like over the last year (starting on December 3rd, 2019).

©Yahoo! Finance

Some of the stock’s lowest trading values were in mid-March, which makes sense as that is around the time that Disney announced the closure of Walt Disney World Resort, Disneyland Resort, Disneyland Paris, and Disney Cruise Line. Hong Kong Disneyland and Shanghai Disneyland had already closed in January, and Tokyo Disney Resort had closed in February.

Enchanted Storybook Castle at Shanghai Disney ©Disney

A lot has changed since March though. All of the Disney theme parks except those at Disneyland Resort reopened, and Disney released Mulan on Disney+ through premiere access and opened at the top of China’s box office despite international controversy. Season 2 of Disney+’s hit show The Mandalorian premiered, new attractions opened at Tokyo Disneyland, and Buena Vista Street reopened as part of Downtown Disney in Disneyland Resort in California.

Buena Vista Street

But, not everything has been positive. Disney has announced huge layoffs affecting thousands of its employees, Disney Cruise Line has canceled its sailings through January of 2021, two international Disney theme parks have been forced to close again, and Disney has delayed some of its feature films including Black Widow.

©Disney

Yet still, amidst all the changes and despite Disney reporting millions in revenue losses during their last quarterly earnings call, Disney’s stock is now trading at high values. It appears some investors see the value in the Disney brand as a whole, and feel hopeful due to its ability to successfully reopen its parks in the past and release quality content despite the pandemic.

©Disney

We’re set to receive lots more updates on the future of The Disney Company in just a few days during its Virtual Investor Day. Repeatedly throughout the Q4 earnings call, Disney representatives noted that much more information would be provided on Investor Day about Disney’s evolving Direct-to-Consumer (DTC) strategy, increased investment in their DTC platforms, and more.

©Disney

We’re definitely interested to hear more about where the future of the Company is headed and how the news revealed as Investor Day gets closer or on Investor Day itself will impact stock values. We’ll be sure to keep an eye out for more updates and let you know what we find.

Click here to see the BIGGEST details you missed from Disney’s Q4 Earnings Call!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

Do you own any Disney stock? Let us know in the comments!

The post NEWS: Disney Stock Hits High Trading Values Ahead of Investor Day first appeared on the disney food blog.