Back in February, the Walt Disney Company revealed its financial standings after experiencing extreme losses amidst the closures of 2020. The Q1 Earnings Call for 2021 detailed that Disney lost billions of dollars. Yet, things have been looking up as of late as Disneyland has reopened and plans are in place for a hopeful reopening of the Disney Cruise Line.

Now that the past few months have brought a bunch of new developments into the mix, the Q2 Earnings Call will surely have a LOT of major details. And, you can read on to find out all the major notes that were discussed in the report!

Overall Financial Results

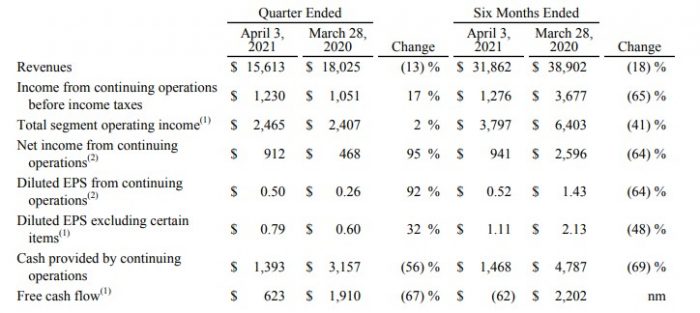

The second fiscal quarter of the year took place from January 3rd, 2021 through April 3rd, 2021 and marks the fifth consecutive fiscal quarter to be significantly affected by the global health crisis. Still, compared to the second quarter of 2020, the first quarter of the global health crisis, Disney has seen an improvement in performance. This is the first time we’ve seen a quarter compared to a prior-year quarter that was affected by the crisis.

©The Walt Disney Company

Overall, Disney reported a 92% increase in earnings from continuing operations in Q2. The 2020 Q2 saw Earnings Per Share (EPS) at $0.26 where this quarter brought in $0.50. As a note, EPS were $1.17 in the quarter prior to the global health crisis. So, we’re seeing an improvement, but still a significant drop from pre-crisis levels. Income reflected a 17% improvement over the prior-year quarter from $1,051,000,000 to $1,230,000,000.

©Disney

Of the results, Disney CEO Bob Chapek notes, “We’re pleased to see more encouraging signs of recovery across our businesses, and we remain focused on ramping up our operations while also fueling long-term growth for the Company. This is clearly reflected in the reopening of our theme parks and resorts, increased production at our studios, the continued success of our streaming services, and the expansion of our unrivaled portfolio of multiyear sports rights deals for ESPN and ESPN+.”

Disney Parks, Experiences & Products

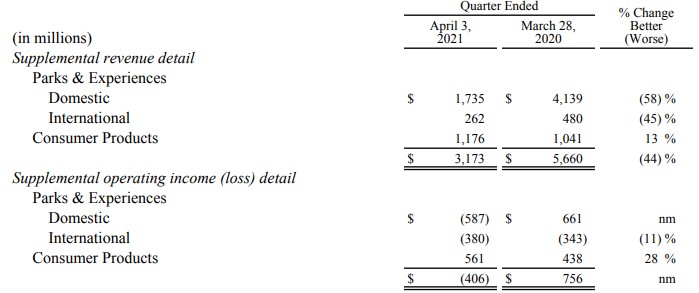

The largest adverse impact on the Walt Disney Company as a whole was in the Parks, Experiences and Products segment, as has been the case for the last year.

©Disney

The report notes an approximate $1.2 billion loss in Q2 “due to decreases at our parks and experiences business, partially offset by growth at our consumer products business.” Though the losses are significant, the figure is nearly half the losses experienced in Q1.

Click here to learn more about the losses experienced at the Disney parks.

During the earnings call, Chapek also announced that Walt Disney World has already begun further increasing capacity at this time. This comes as social distancing is set to decrease from 6 feet to 3 feet in the parks soon.

Magic Kingdom

Chapek did not share a specific percentage of capacity.

To learn more about the increase, click here!

Chapek also made comments on today’s update from the CDC on mask usage by vaccinated people.

Face Mask

Though he did not announce any specific changes to the mask mandates in the theme parks, he said that this was big news “particularly if anybody’s been in Florida in the middle of the summer with a mask on.”

Learn more about these comments here!

Disney Media and Entertainment Division

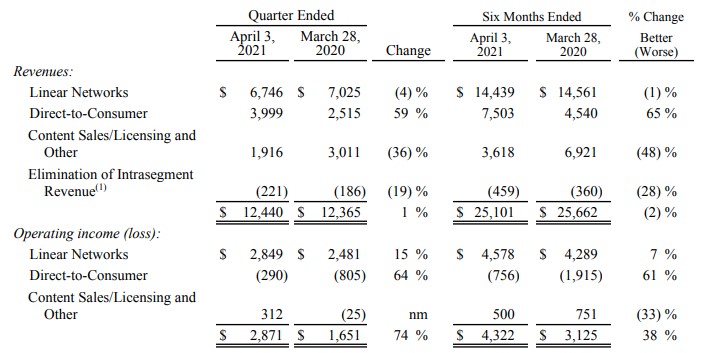

When the Q1 Earnings Call was held in February, it was reported that there was only a small decrease in operating income of just 2% for the media segment. Months later, now there has been significant improvement.

©Disney

The situation for Disney Media and Entertainment saw improved results to last year with a 74% increase in operating income. Last year’s Q1 saw an income of $1,651,000,000 and this year saw $2,871,000,000.

©Disney

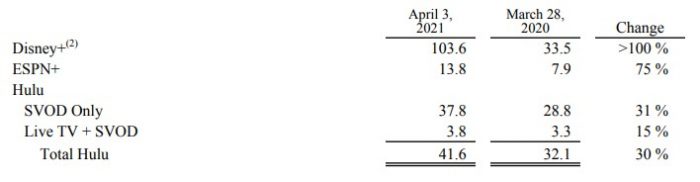

The Direct-to-Consumer segment continues to see growth with Disney+ increasing subscriber count by over 200%, ESPN+ increasing subscriber count by 75%, and Hulu increasing subscriber count by 30%.

©Disney

Disney+ currently reports approximately 103.6 million subscribers.

Want to learn more about the Disney+ results? Click here!

As we continue to find out more information about the Walt Disney Company, we’ll be sure to give you a look at how things change throughout the rest of this year. Be sure to stay tuned with DFB for MORE insights from the earnings report!

Click here to learn more about last quarter’s results!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

Don’t Miss Out on Any Disney Fun!

Order Your Copy of the 2021 DFB Guide to Walt Disney World Dining Today!

With more than 750 pages, the 2021 DFB Guide to Walt Disney World Dining is full of tips and planning tools developed by Disney World experts over 30+ years of visits. We’ve done the research for you, so you’ll know just which spots will uniquely suit your family’s needs!

With more than 750 pages, the 2021 DFB Guide to Walt Disney World Dining is full of tips and planning tools developed by Disney World experts over 30+ years of visits. We’ve done the research for you, so you’ll know just which spots will uniquely suit your family’s needs!

With mini-reviews of every single restaurant, bar, lounge, kiosk and more; an entire chapter on the best snacks in Disney World; full Disney Dining Plan analysis (and how to get FREE dining); and a full chapter on discounts and deals; you’ll have everything you need to plan your best vacation yet.

Click here to order your copy of the 2021 DFB Guide to Walt Disney World Dining E-book with code WDW2021 to save 25% off the cover price today!

Use code WDW2021 at check-out for 25% off the cover price today!

Our guides are backed by a 100% money-back guarantee, so you have nothing to lose.

Have you visited a Disney Park this year? Let us know in the comments below!

The post EVERYTHING You Need to Know from the Walt Disney Company Q2 Earnings Call first appeared on the disney food blog.