Over the past year (and beyond), we’ve been keeping an eye on Disney’s stock and how it has changed with the onset of the pandemic, the launch of hit shows on Disney+, and more.

Now, with just a little less than a month to go to Disney+ Day and Disney’s next quarterly earnings call, we’re getting an updated look at Disney’s stock, and some analysts’ thoughts on the situation with Disney+.

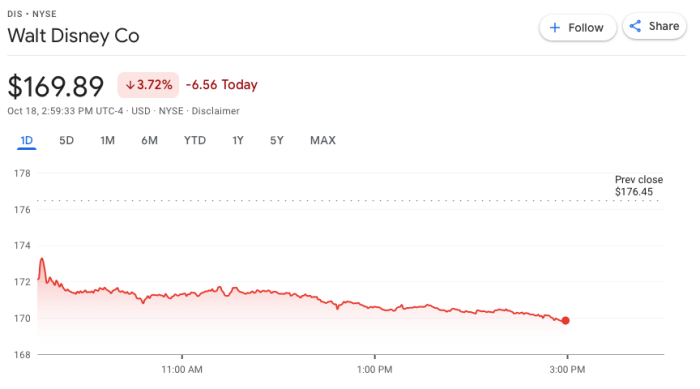

According to Forbes, Disney’s shares fell 3% on Monday, October 18th, “after analysts at Barclays downgraded the stock.” Specifically, Barclays warned that Disney’s long-term subscriber goals for Disney+ “appear overly optimistic.”

Barclays analyst Kannan Venkateshwar downgraded Disney’s stock from an “outperform” to an “equal weight” rating and lowered the price target from $210 per share to $175 per share.

Forbes notes that Disney stocks are up nearly 40% over the past year, but after peaking at $200 per share earlier this year, the price has pulled back.

As Forbes reports, in July of this year, Disney shared that it had 116 million subscribers for Disney+ and Hotstar. Disney expects to have between 230 and 260 million total subscribers by the end of fiscal year 2024.

But, Barclays analysts are skeptical. They’ve noted concerns about Disney+’s slowing growth and “the fact that Disney+ has been producing far less new content than its chief competitor, Netflix.” Netflix had approximately 209 million subscribers in July.

As of July 3, 2021, Disney+ had grown to 116 million subscribers. But, this actually exceeded Disney’s own projections for 113 million subscribers. Some sources did note, however, that growth had slowed earlier in the year. While Disney+ added 8.7 million subscribers within a recent period, some had hoped for more than 14 million, according to the New York Times. Still, some sources actually have reported that Disney+ is set to have MORE subscribers than Netflix by the year 2025.

Barclays has its doubts about Disney+. Barclays also noted that Hotstar could take a hit as it deals with expiring sports rights in India.

When it comes to content, one Barclays analyst noted, “In order to get to its long-term streaming subscription guide, Disney needs to more than double its current pace of growth to at least the same level as Netflix.”

It is possible that Disney+ day, which is set to take place in November, will be the answer to some of these concerns. On that day, quite a lot of new movies and series will be released on Disney+ and we expect more news will also be shared.

At the moment, according to Google, Disney’s shares are priced at around $169.89 per share.

Disney’s next quarterly earnings call is set for November 10th. We expect to learn more during that call about the situation with Disney+ and other areas of the company. Be sure to check back with us for more details.

Click here to see the FULL lineup for Disney+ Day!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

The post Why Some Analysts Are Concerned About Disney+ first appeared on the disney food blog.