Disney has reported HUGE revenue figures when it comes to its theme parks, increasing numbers of Disney+ subscribers, and a look at demand for the parks that is reportedly resilient and long-lasting…but Disney’s stock values aren’t celebrating.

Over the past few years, we’ve seen Disney stock hit some low lows and high highs. So where is it at right now? Let’s take a look together.

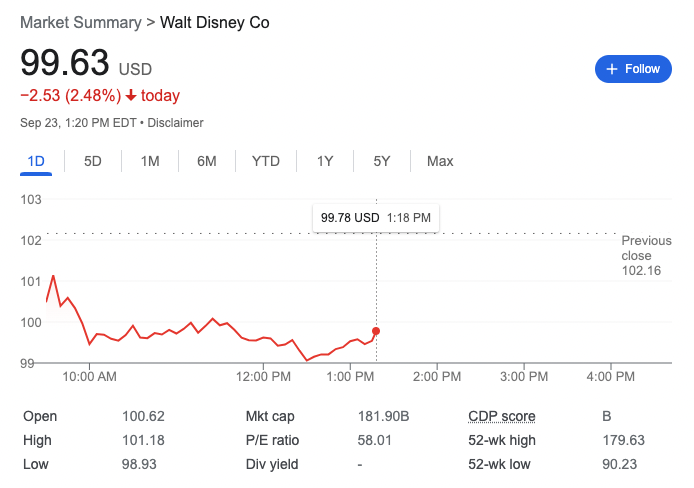

On September 23rd, 2022, Disney stock was trading at around $99.71 when we checked. That marked a slight decrease from where the stock began the day.

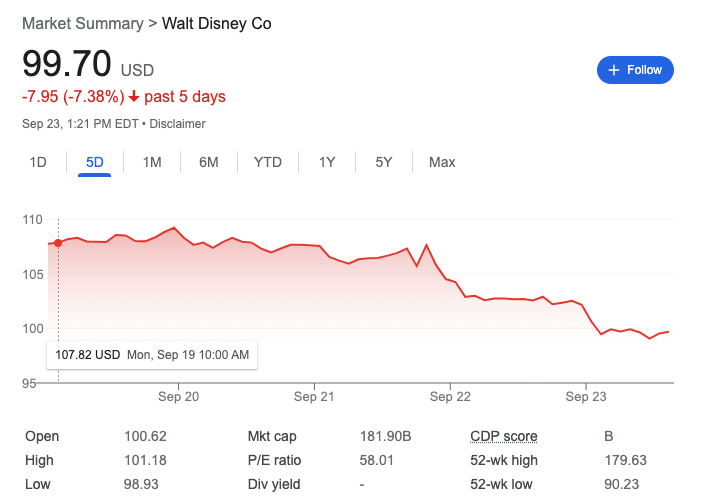

Looking at the last 5-day period, the numbers seem to be going in a less-than-ideal direction for the Company.

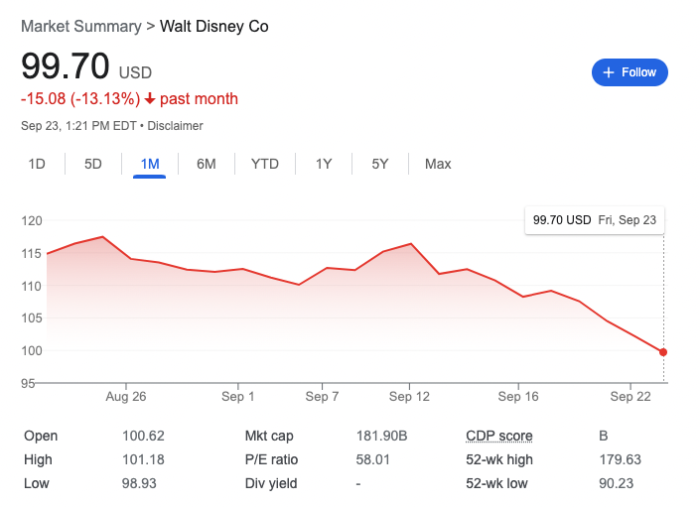

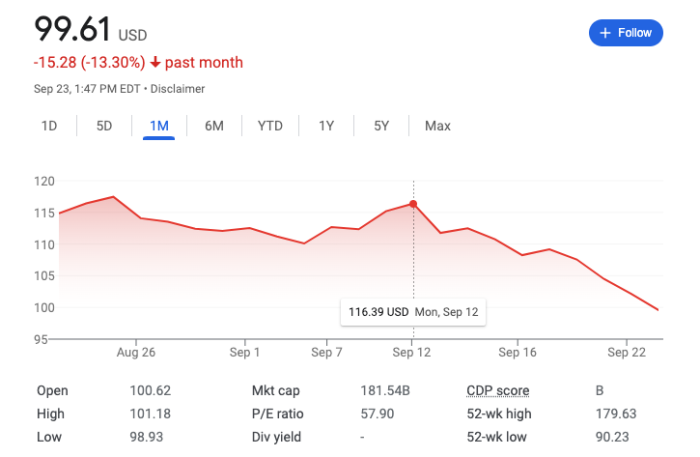

Unfortunately, the 1-month look doesn’t look all that great either, as Disney’s stock is hitting levels lower than what was seen 30 days ago.

Looking at the stock values from the beginning of 2022 to now, you can see some big changes. The stock hit values in the $150s earlier in the year, dropped to the low 90s in July, picked up again in August, and is now slipping once more.

Though Disney saw a slight increase in stock values following some strong streaming and parks news, that bump has faded away. Not even excitement over announcements shared at the D23 Expo (Disney’s biggest event of the year) could provide a consistent push for Disney stock values.

D23 Expo was held on September 9th-11th, during which time Disney revealed first looks at some upcoming projects (like Tiana’s Bayou Adventure which will replace Splash Mountain), announced NEW movies, shared NEW trailers, and more.

Following the news from the Expo, Disney did see a bump in stock value — but that has since dropped.

Perhaps some were disappointed by the lack of concrete news for future park projects or the absence of news about certain things that had been previously announced.

While the low value isn’t great news for current stockholders, if you have been looking to buy Disney stock you may want to watch those prices and see if it’s a good time to buy (before stock values go up).

Some of that drop in value could also be due to things outside of Disney’s control. CNBC points out that stocks tumbled on Friday with the Dow Jones Industrial Average falling more than 700 points, and the 30-stock index falling 20% from its high. This is known as “bear market territory” when it comes to Wall Street.

Quincy Krosby from LPL Financial shared, “The market has been transitioning clearly and quickly from worries over inflation to concerns over the aggressive Federal Reserve campaign.” CNBC reports that surging interest rates and “foreign currency turmoil” have “heightened fears of a global recession,” impacting the stock market as a result.

Of course, things are subject to change again. There are several events left in 2022 that could encourage investors to feel more confident about the Company and increase stock values. There’s EPCOT’s 40th Anniversary coming in October, the release of a new Disney animated film and a new Avatar movie in theaters, and Disney’s Q4 earnings report which should come later this year. If Disney has good news to share and hits large levels of success, we could see stock values jump up. A change in overall market conditions could also alter Disney’s stock values.

We’ll keep an eye out for updates, but for now, you might want to close your eyes and not look too closely at the value of all those shares of Disney stock you’ve got.

For more general Disney news on things that could impact the future of the company, click here to see 8 BIG things that will change in Disney’s future, and click here to see what Disney CEO Bob Chapek has to say about price increases, annual passes, and park passes.

Click here to see some big takeaways from Disney’s Q3 earnings report

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

Don’t Miss Out on Any Disney Fun!

Order Your Copy of the 2022 DFB Guide to Walt Disney World Dining Today!

With more than 750 pages, the 2022 DFB Guide to Walt Disney World Dining is full of tips and planning tools developed by Disney World experts over 30+ years of visits. We’ve done the research for you, so you’ll know just which spots will uniquely suit your family’s needs!

With more than 750 pages, the 2022 DFB Guide to Walt Disney World Dining is full of tips and planning tools developed by Disney World experts over 30+ years of visits. We’ve done the research for you, so you’ll know just which spots will uniquely suit your family’s needs!

With mini-reviews of every single restaurant, bar, lounge, kiosk and more; an entire chapter on the best snacks in Disney World; full Disney Dining Plan analysis (and how to get FREE dining); and a full chapter on discounts and deals; you’ll have everything you need to plan your best vacation yet.

Click here to order your copy of the 2022 DFB Guide to Walt Disney World Dining E-book with code WDW2022 to save 25% off the cover price today!

Use code WDW2022 at check-out for 25% off the cover price today!

Our guides are backed by a 100% money-back guarantee, so you have nothing to lose.

Are you a Disney stockholder? Tell us in the comments.

The post Disney Stock Values DROP Weeks After Its Biggest Event of the Year first appeared on the disney food blog.