There have recently been some big shake-ups when it comes to Disney leadership, but one group is pushing for even more changes, and their claims have started a proxy fight with Disney’s Board of Directors.

The Trian Partners have nominated Nelson Peltz to be elected to Disney’s Board of Directors, but the current board does not endorse Peltz. So what exactly does Peltz want, and why doesn’t Disney want him on the Board? Let’s dig in.

According to Business Wire, “Trian Partners L.P. and Trian Partners Parallel Fund I, L.P., wholly owned subsidiaries of Trian Fund Management, L.P., along with other entities affiliated with Nelson Peltz (collectively, the “Trian Group”), have nominated Nelson Peltz for election as director at the Annual Meeting in opposition to the nominees recommended by the Board, and brought a proposal to amend Disney’s Bylaws.”

In response, the Disney Board stated that they do NOT endorse the Peltz and “recommends that shareholders not support” him either and “instead vote FOR all the Company’s nominees.”

Who Is Nelson Peltz?

Peltz and the Trian Partners group have long been interested in The Walt Disney Company and have commented on many of the company’s decisions. Peltz has met with Disney executives and Board members several times (CNBC). According to CNBC, “The activist firm said it owns about 9.4 million shares valued at approximately $900 million, which it first accumulated a few months ago.”

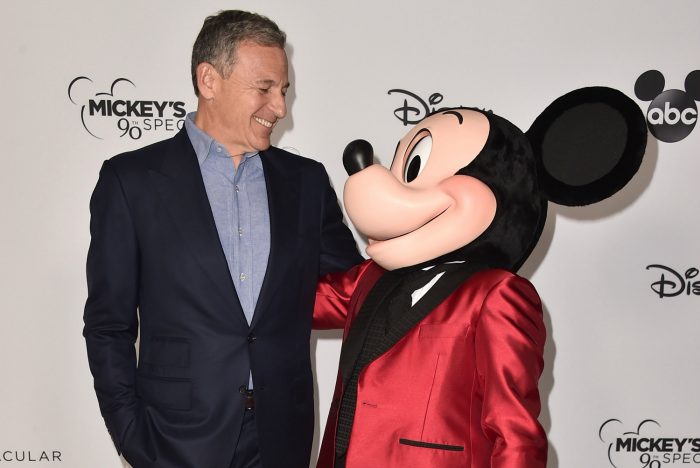

Peltz was reportedly opposed to the return of Bob Iger as the company’s CEO.

What Do Peltz and the Trian Partners Want?

So why does Peltz want a seat on the Board? The Trian group has commented that they believe Disney “lost its way, resulting in a rapid deterioration in its financial performance.” Peltz’s main complaints about the company revolve around Disney’s decision to acquire Fox back in 2019 and “poor corporate governance.”

Disney acquired Fox in 2019, paying about $71 billion for the acquisition. According to Peltz, “Fox hurt this company. Fox took the dividend away. Fox turned what was once a pristine balance sheet into a mess.”

Another area where Disney struggles is streaming, and the Trian group pointed out that the company’s strategy has resulted in problems with profitability, despite the fact that Disney is “reaching similar revenues as Netflix and having a significant IP advantage.” The firm accused Disney of “overearning at its theme parks to subsidize streaming losses,” which it calls a “lack of cost discipline.”

Peltz has stated that Disney needs to make a decision: they should get out of streaming entirely or buy all of Hulu. Peltz stated, “They must buy Hulu, that unfortunately means the company will have a debt load going forward for several years.” Disney owns two-thirds of Hulu already, and to own the entirety of the streaming service they would have to buy the remaining third from Comcast.

The Trian group stated that Disney has lately experienced “poor corporate governance,” which resulted in “failed succession planning” and “over-the-top compensation practices.”

Despite the fact that Peltz reportedly opposed the return of Bob Iger as the company’s CEO, the Trian group has said that they “don’t want to replace Iger, but rather work with him to ensure a successful CEO transition within the next two years.” That issue of succession is one of the most pressing issues the Board is facing right now.

Peltz reportedly said that another reason he’d like to be on the board is “so he can get access to internal numbers and tell other members if they’re missing out on opportunities.” He said, “I don’t need to overwhelm [the Board]. I don’t need more than one person on the board.”

In short, Peltz has seen several areas where he thinks Disney could improve, and he wants a say in Disney’s decision-making moving forward.

How Is Disney Responding?

Disney isn’t supportive of Peltz joining the Board of Directors and has urged shareholders to vote for the Board’s current nominees instead. The Board also announced on Wednesday that Mark Parker would become the new Chairman of the Board following Susan Arnold’s exit after the next Annual Meeting of Shareholders. Parker will also lead a committee that is focused on finding a successor for Bob Iger once the CEO leaves.

According to CNBC, some “people close to Disney” have said that Disney has previously offered Peltz the opportunity to “enter into an information-sharing pact under a nondisclosure agreement” and to meet with Disney executives and the board regularly. Peltz was not offered the ability to sit in on the board meetings, though. So it’s clear that Disney finds Peltz’s contributions valuable, but the Board does not seem to want him to have voting privileges.

Disney has also defended its recent financial decisions, stating that the company “has had a long-term track record of financial and creative success” and has “built on the ability to leverage its rich intellectual property and unparalleled storytelling across its many businesses, from theatrical, streaming, and linear broadcast to parks and resorts.”

Disney hasn’t announced when the next meeting of shareholders will take place, but we’ll watch for more updates on this developing situation. Stay tuned to DFB for all the latest Disney news!

Click here to learn 4 important secrets about the Iger-Chapek conflict.

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

The post Activist Group Believes Disney Has “Lost Its Way” and Pushes for Board Changes first appeared on the disney food blog.