We just got some MAJOR updates from the Walt Disney Company.

On February 8th, 2023, Disney released its earnings report for the first quarter of the 2023 fiscal year (this covers a period from early October 2022 through December 2022). A lot has changed since the last report we got in November of 2022. Bob Chapek is no longer the CEO, Bob Iger has returned, Disney+ has launched its ad-supported tier, and some park perks are back. Chapek was still CEO for part of the period covered by this earnings call though, and Iger would have only had a few weeks to really change things. So how is the Company doing financially? Let’s find out.

It’s important to keep in mind that this news is all being released just weeks ahead of another critical Disney date — April 3rd. That is when Disney will hold its 2023 annual meeting of shareholders and we’ll finally get a resolution to Nelson Peltz’s proxy battle for a seat on the Board of Directors.

Overall Financial Results

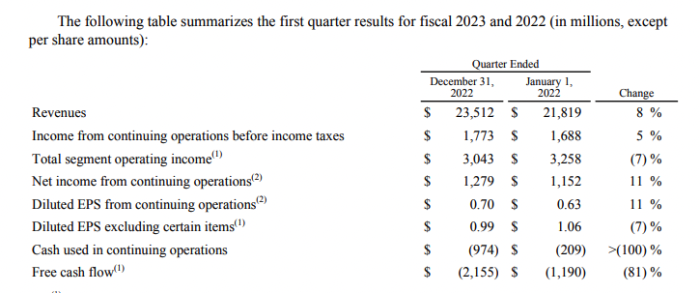

In terms of overall financial results, here’s what Disney reported:

- Revenues for the quarter grew 8%.

- Diluted earnings per share (EPS) from continuing operations for the quarter increased to $0.70 from $0.63 in the prior-year quarter.

- Excluding certain items(1), diluted EPS for the quarter decreased to $0.99 from $1.06 in the prior-year quarter.

Bob Iger called this a “solid first quarter,” and said that following this they are “embarking on a significant transformation, one that will maximize the potential of our world-class creative teams and our unparalleled brands and franchises.” Iger noted that the work they’re doing to “reshape our company around creativity, while reducing expenses, will lead to sustained growth and profitability for our streaming business, better position us to weather future disruption and global economic challenges, and deliver value for our shareholders.”

Below you can see a chart of the first quarter of fiscal year 2023 (the quarter that they’re reporting on now) versus the same quarter in 2022. Compared to the prior year quarter, there were increases in many areas, but there have been losses in total segment operating income, and diluted EPS excluding certain items.

Let’s take a look at some specific parts of Disney’s business.

Disney+ Subscribers

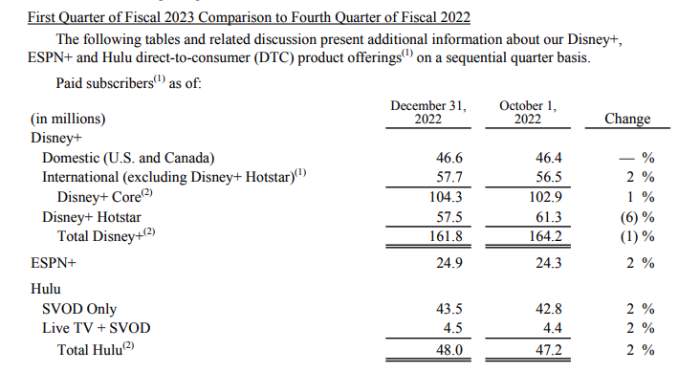

Disney has provided a HUGE update on Disney+ subscriber numbers. Back in October of 2022, the total number of Disney+ subscribers was 164.2 million (including Hotstar and international subscriptions). But as of the end of Q1 for FY 2023, the number of subscribers has actually DECREASED to 161.8 million.

No, that’s not a typo, total Disney+ subscriber numbers actually DECREASED by December 31st, 2022 compared to just a few months before (October 1st, 2022).

It appears the loss was primarily in Disney+ Hotstar. Domestic Disney+ subscriptions (U.S. and Canada) increased ever so slightly from 46.4 million to 46.6 million, and International subscriptions (excluding Disney+ Hotstar) increased slightly as well.

Disney+ Hotstar, however, saw a loss from 61.3 million subscribers in October of 2022 to 57.5 million by December 31st, 2022.

Let’s take a look at other important Disney+ numbers.

Other Disney+ News

We got some other critical Disney+ updates as well. Back in November of 2022 is when we saw those huge direct-to-consumer losses, to the tune of nearly $1.5 BILLION in Q4 of FY 2022. This massive loss (and the handling of the earnings call surrounding this loss) is one of the major reasons why Chapek was ousted from his CEO position.

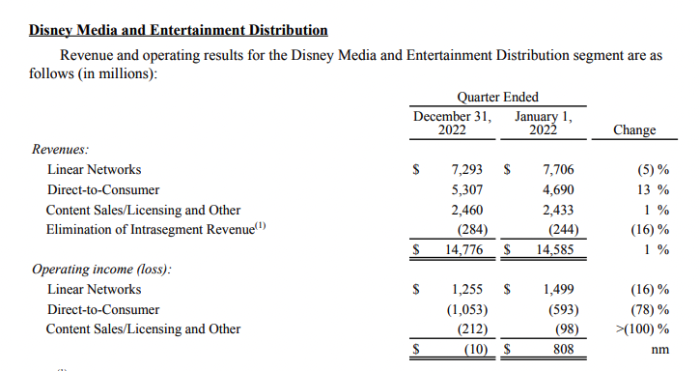

So just how has that changed for Q1 of FY 2023? Well, things are better, but not by that much. In Q1 of FY 2023, Disney reported an operating loss of 1.053 billion with its direct-to-consumer business. That is compared to a loss of just 593 million in the prior-year quarter (Q1 of FY 2022).

Disney’s revenue in Linear Networks also slightly dropped. But revenues for Disney’s direct-to-consumer business did increase in Q1 of FY 2023 compared to the prior-year quarter. It looks like content sales/licensing and other also increased slightly compared to 2022.

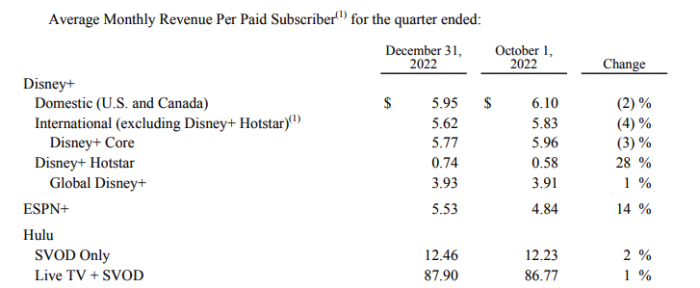

We’ve also seen a change in the average monthly revenue per paid subscriber when it comes to Disney+. That number has actually DROPPED for Disney+ domestic, despite the introduction of the ad-supported tier and increased price for the ad-free tier.

But the average monthly revenue per paid subscriber increased with Disney+ Hotstar, leading to an overall increase compared to October of 2022.

Disney notes that the drop in average monthly revenue per paid subscriber for domestic Disney+ dropped due to “a higher mix of subscribers to multi-product offerings, partially offset by an increase in retail pricing.”

Overall, when it comes to streaming, “Direct-to-Consumer revenues for the quarter increased 13% to $5.3 billion and operating loss increased $0.5 billion to $1.1 billion.”

They noted that at Disney+ there were “higher programming and production costs and increased technology costs,” and the “increase in programming and production costs was attributable to more content provided on the service and higher average costs per hour, which included an increased mix of original content.”

Disney Parks Update

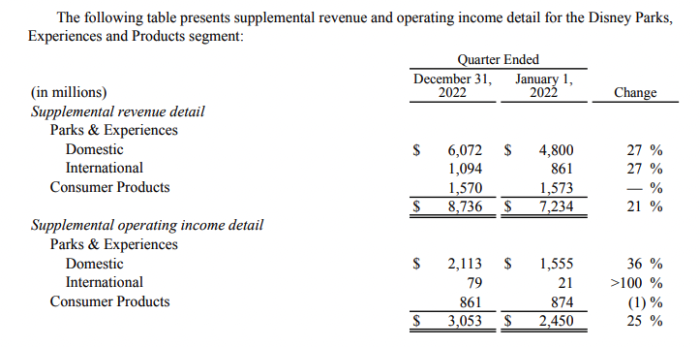

When it comes to the Disney Parks, Experiences, and Products division, things had been going significantly better than the streaming world recently. In November of 2022, we saw that the Parks, Experiences, and Products division had a total revenue of $7.4 BILLION, significantly up from the same quarter in 2021.

But have the parks been able to continue on this path of victory? It seems so. Disney reports that the Parks, Experiences, and Products division’s “revenues for the quarter increased 21% to $8.7 billion and segment operating income increased 25% to $3.1 billion.”

Parks & Experiences (Domestic) had a particularly big jump going from 4.8 billion in January 2022 to 6.072 billion at the end of December 2022.

Disney notes that the “Operating income growth at our domestic parks and experiences was due to higher volumes and increased guest spending, partially offset by cost inflation, higher operations support costs and increased costs for new guest offerings.”

Where did the higher volumes come from? Disney attributes that to “increases in passenger cruise days, attendance and occupied room nights.” What about guest spending in the parks? That increase was due to “an increase in average per capita ticket revenue driven by Genie+ and Lightning Lane.”

That’s a brief overview of the earnings report. We’ll be uncovering more details within Disney’s earnings report and listening for updates during the earnings call, so check back for updates.

With activist investor Nelson Peltz on the hunt for a seat on the Board, we expect many parts of this earnings report could be crucial to Disney’s upcoming shareholder meeting in April. We’ll keep an eye out for more news as that date approaches.

For more Disney Company news, see our posts below:

- Why a Random Date in April Will be CRITICAL to the Walt Disney Company

- Can Activist Investors Derail Bob Iger’s Board at Disney?

- Disney Fears One Change Could Be “DISRUPTIVE” at a Crucial Time

- Investor Wants Disney to FIRE Board Member

- The Big Disney Parks Changes that Activist Investors Are Pushing

- Who Is Nelson Peltz and Why Do People Care What He Says About Disney?

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

Don’t Miss Out on Any Disney Fun!

Order Your Copy of the 2023 DFB Guide to Walt Disney World Dining Today!

With more than 900 pages, the 2023 DFB Guide to Walt Disney World Dining is full of tips and planning tools developed by Disney World experts over 30+ years of visits. We’ve done the research for you, so you’ll know just which spots will uniquely suit your family’s needs!

With more than 900 pages, the 2023 DFB Guide to Walt Disney World Dining is full of tips and planning tools developed by Disney World experts over 30+ years of visits. We’ve done the research for you, so you’ll know just which spots will uniquely suit your family’s needs!

You’ll get a Reference Guide, a 101 Plan, and a Printables and Resources Guide! With mini-reviews of every single restaurant, bar, lounge, kiosk and more; an entire chapter on the best snacks in Disney World; full Disney Dining Plan analysis; and a full chapter on discounts and deals; you’ll have everything you need to plan your best vacation yet.

Click here to order your copy of the 2023 DFB Guide to Walt Disney World Dining E-book with code WDW2023 to save 25% off the cover price today!

Use code WDW2023 at check-out for 25% off the cover price today!

Our guides are backed by a 100% money-back guarantee, so you have nothing to lose.

What surprised you the most about this financial information from Disney? Tell us in the comments.

The post Disney Reveals Major News As Critical Date Nears first appeared on the disney food blog.